May 18, 2023

By: Katelyn J. Dougherty, Esq.

Attention all business owners! Let’s talk about the power of budgeting and the key considerations that can make or break your financial success.

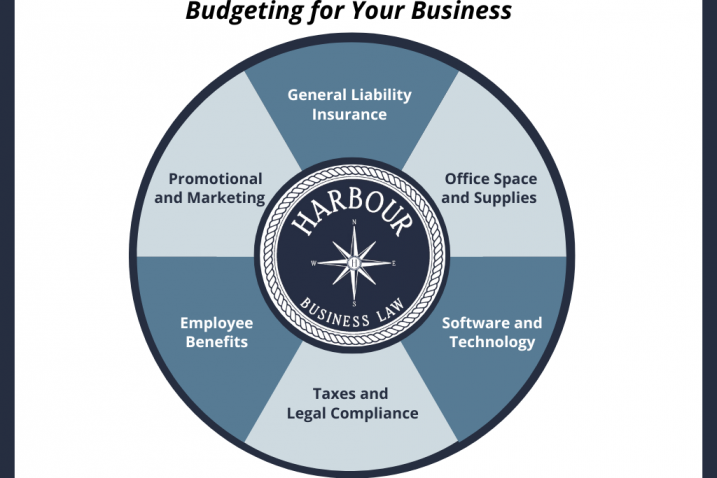

When creating a budget for your business, it’s vital to take into account various factors to ensure a solid financial foundation. Here are some initial and crucial elements to consider:

- General Liability Insurance: Protecting your business from unexpected risks is essential. Allocate a portion of your budget to cover general liability insurance costs. This shields you from potential lawsuits, property damage claims, or accidents. It’s an investment in safeguarding your business’s reputation and assets.

- Office Space and Supplies: Whether you have a physical or virtual workspace, accounting for office-related expenses is key. Include rent, utilities, maintenance, and essential supplies like furniture, stationery, and equipment in your budget. A well-equipped and comfortable workspace fosters productivity and professionalism.

- Software and Technology: In today’s digital world, investing in software and technology is paramount. Allocate funds for software licenses, subscriptions, hardware upgrades, cybersecurity measures, and regular technology maintenance. Staying up to date with the latest tools empowers your business with efficiency and innovation.

- Promotional and Marketing: Building brand visibility and attracting customers requires a strategic marketing approach. Incorporate a budget for promotional activities such as social media advertising, content creation, website development, print materials, and participation in industry events. Effective marketing drives customer engagement and business growth.

- Employee Benefits: Prioritize the well-being and satisfaction of your team. Include a budget for employee benefits like healthcare plans, retirement contributions, paid time off, training programs, and performance incentives. Investing in your employees fosters loyalty, productivity, and a positive work culture.

- Taxes and Legal Compliance: Don’t forget about tax obligations and legal compliance. Factor in estimated taxes, business license fees, permits, and any legal counsel or accounting services required. Staying compliant with regulations ensures a smooth business operation and avoids potential penalties or legal issues.

Remember these tips as you navigate your budgeting journey:

√ Thoroughly research industry benchmarks and best practices.

√ Regularly review and adjust your budget to adapt to changing circumstances.

√ Involve your team and seek their input to ensure a comprehensive perspective.

√ Prioritize essential expenses while considering long-term growth opportunities.

√ Keep a contingency fund for unexpected costs or emergencies.

By embracing budgeting and considering these vital elements, you’ll establish a solid financial framework for your business’s success.

Don’t have a business attorney? Get in touch with our team by emailing Info@harbourbusinesslaw.com.

This Blog was written by Founding Attorney, Katelyn Dougherty.

DISCLAIMER: This blog is for educational purposes only and does not offer nor substitute legal advice. This blog does not establish an attorney-client relationship and is not for advertising or solicitation purposes. Any of the content contained herein shall not be used to make any decision without first consulting an attorney. The hiring of an attorney is an important decision not to be based on advertisements or blogs. Harbour Business Law expressly disclaims any and all liability in regard to any actions, or lack thereof, based on any contents of this blog.