By: Katelyn J. Dougherty, Esq.

When it comes to starting a small business, one of the most important decisions made is what type of entity to form, followed by what type of tax election you should choose from the options available to you.

DISCLAIMER: This blog is for education purposes only, and should not be relied on when making tax-related decisions. It is important to consult with a tax professional before making any tax elections to ensure that it’s the best choice for the company’s specific circumstances.

Taxation Categories

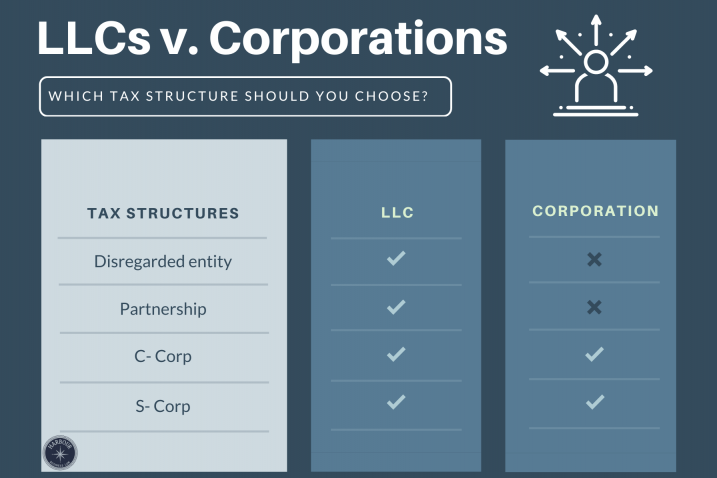

First, it’s important to state that the type of entity you form (such as an LLC or a Corp) is not the same thing as a tax election (disregarded, partnership, S-Corp, etc.).

For many entrepreneurs, they elect to form a Limited Liability Company (LLC). Doing so then gives them various options when it comes to tax elections.

Disregarded: An LLC can be taxed as a disregarded entity when it has a single owner, also known as a single-member LLC. In this case, the IRS will treat the LLC as a “disregarded entity” for tax purposes, which means that the LLC itself does not pay taxes on its profits. Instead, the profits and losses of the LLC are reported on the owner’s personal tax return.

Partnership: An LLC can be taxed as a partnership when it has two or more owners, also known as members. In this case, the IRS will automatically treat the LLC as a “pass-through” entity for tax purposes, which means that the LLC itself does not pay taxes on its profits. Instead, the LLC’s profits and losses are not taxed at the entity level; rather, they are distributed to its members, who report them on their personal tax returns. This is similar to the way that a partnership is taxed.

C – Corporation (C-Corp.): An LLC can be taxed as a corporation by filing Form 8832 with the IRS and indicating that it wants to be taxed as a corporation. If the LLC is taxed as a corporation, it will be treated as a separate entity for tax purposes and will pay corporate income taxes on its profits. This can be advantageous for LLCs that have a significant amount of profits and want to retain earnings in the company, as corporate tax rates may be lower than individual tax rates. However, it’s important to weigh the benefits and drawbacks of being taxed as a corporation before making the election.

S – Corporation (S-Corp.): An LLC can be taxed as a S – Corporation by filing Form 2553 with the IRS and meeting certain eligibility requirements. If the LLC meets these requirements and makes the S corporation election, it will be taxed as a pass-through entity, similar to a partnership. The LLC itself does not pay federal income taxes on its profits. Instead, the LLC’s profits and losses are passed through to its shareholders, who report them on their individual tax returns. This can lead to increased tax savings for both the LLC and its shareholders, as they may avoid double taxation on corporate profits.

A Look into the S – Corp Tax Election

The S Corp is an appealing option due to its tax advantages and flexibility. However, deciding when to make the S Corp election can be a tricky decision. In this blog, we’ll explore when it’s the right time to make a Subchapter S Corporation tax election.

First, it’s important to understand what an S Corp is and what makes it different from other types of entities. An S Corp is a pass-through entity, which means that the business itself doesn’t pay income taxes. Instead, the profits and losses of the business are passed through to the shareholders, who report them on their individual tax returns. This can result in significant tax savings for the business and its owners.

To qualify as an S Corp, a business must meet certain criteria, including:

Once a business meets these requirements, it can make an S Corp election by filing Form 2553 with the IRS. This election must be made no later than two months and 15 days after the start of the tax year in which the election is to take effect, or at any time during the preceding tax year. However, it’s best to confer with your CPA, as there are usually exceptions to the rule.

So, when is the right time to make an S Corp election? The answer depends on a variety of factors, including your business’s current and projected income, your personal tax situation, and your long-term goals for the business.

If your business is just starting out and you’re not yet making a significant amount of income, it may not make sense to make the S Corp election right away. Operating as a sole proprietorship or partnership could be more beneficial in this situation, as it allows for taking advantage of the lower tax rates offered by those entities.

On the other hand, if your business is already generating substantial income, making the S Corp election could result in significant tax savings. This is because S Corps are only taxed on their profits at the shareholder level, rather than both the corporate and individual levels. Additionally, S Corps can allow for certain deductions and benefits that may not be available to other types of entities.

Your personal tax situation is also an important factor to consider when deciding when to make the S Corp election. If you’re currently in a high tax bracket, switching to an S Corp could help you save on taxes. On the other hand, if you’re in a lower tax bracket, the difference may not be as significant.

Additionally, if an LLC elects S corporation tax status too soon, it could result in negative tax consequences. For example, choosing S corporation status too early for an LLC that hasn’t yet produced significant profits could lead to a higher tax burden as it would require paying reasonable compensation to shareholder-employees. Additionally, if the LLC later needs to terminate its S corporation election, it may be subject to a waiting period before it can make a new S corporation election. This waiting period can result in the LLC being subject to less favorable tax treatment during the waiting period.

Finally, your long-term goals for the business should also be taken into account. If you plan to eventually sell the business or take it public, operating as an S Corp can make the business more attractive to potential buyers or investors. It can also help protect your personal assets in the event of a lawsuit or other legal action.

In conclusion, deciding when to make an S Corp election requires careful consideration of your business’s income, your personal tax situation, and your long-term goals. Consulting with a tax professional or attorney who can provide personalized guidance based on your specific circumstances is recommended if you require clarification on whether an S Corp is a suitable option for your business.

Don’t have a business attorney? Get in touch with our team by emailing Info@harbourbusinesslaw.com.

This Blog was written by Founding Attorney, Katelyn Dougherty.

DISCLAIMER: This blog is for educational purposes only and does not offer nor substitute legal advice. This blog does not establish an attorney-client relationship and is not for advertising or solicitation purposes. Any of the content contained herein shall not be used to make any decision without first consulting an attorney. The hiring of an attorney is an important decision not to be based on advertisements or blogs. Harbour Business Law expressly disclaims any and all liability in regard to any actions, or lack thereof, based on any contents of this blog.